June Data - August Reporting

MICHIGAN UNEMPLOYMENT RATE EDGES DOWN IN JUNE

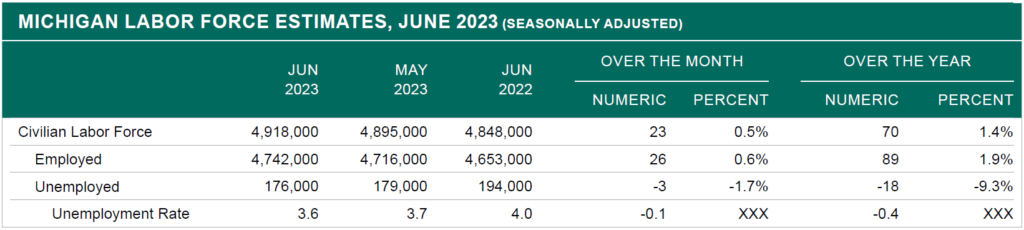

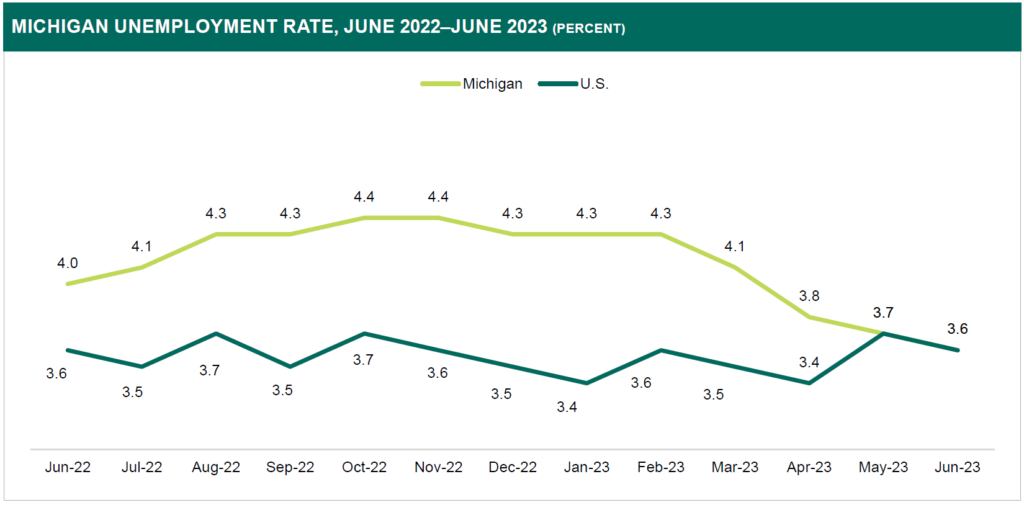

Michigan’s unemployment rate declined by one-tenth of a percentage point on a seasonally adjusted basis to 3.6 percent during June.

The national jobless rate also decreased by one-tenth of a percentage point to 3.6 percent between May and June. For the second consecutive month, the U.S. unemployment rate matched the Michigan rate. The national unemployment rate remained unchanged over the year. Michigan’s jobless rate was reduced by four-tenths of a percentage point since June 2022.

Michigan’s total workforce advanced by 0.5 percent over the month, while the U.S. labor force level was little changed, inching up by only 0.1 percent. Statewide employment increased by 0.6 percent over the month, while the national employment total rose by 0.2 percent. Unemployment in the state declined by 1.7 percent over the month, while the U.S. unemployment total fell by 2.3 percent since May.

Over the year, Michigan’s labor force advanced by 1.4 percent, four-tenths of a percentage point below the workforce gain seen on the national level. Total employment advanced by 1.9 percent over the year both statewide and nationally. Michigan unemployment decreased by 9.3 percent over the year and U.S. unemployment edged up by 0.2 percent since June 2022.

SHIBANI PUTATUNDA

Economic Specialist

Source: Local Area Unemployment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

Source: Local Area Unemployment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

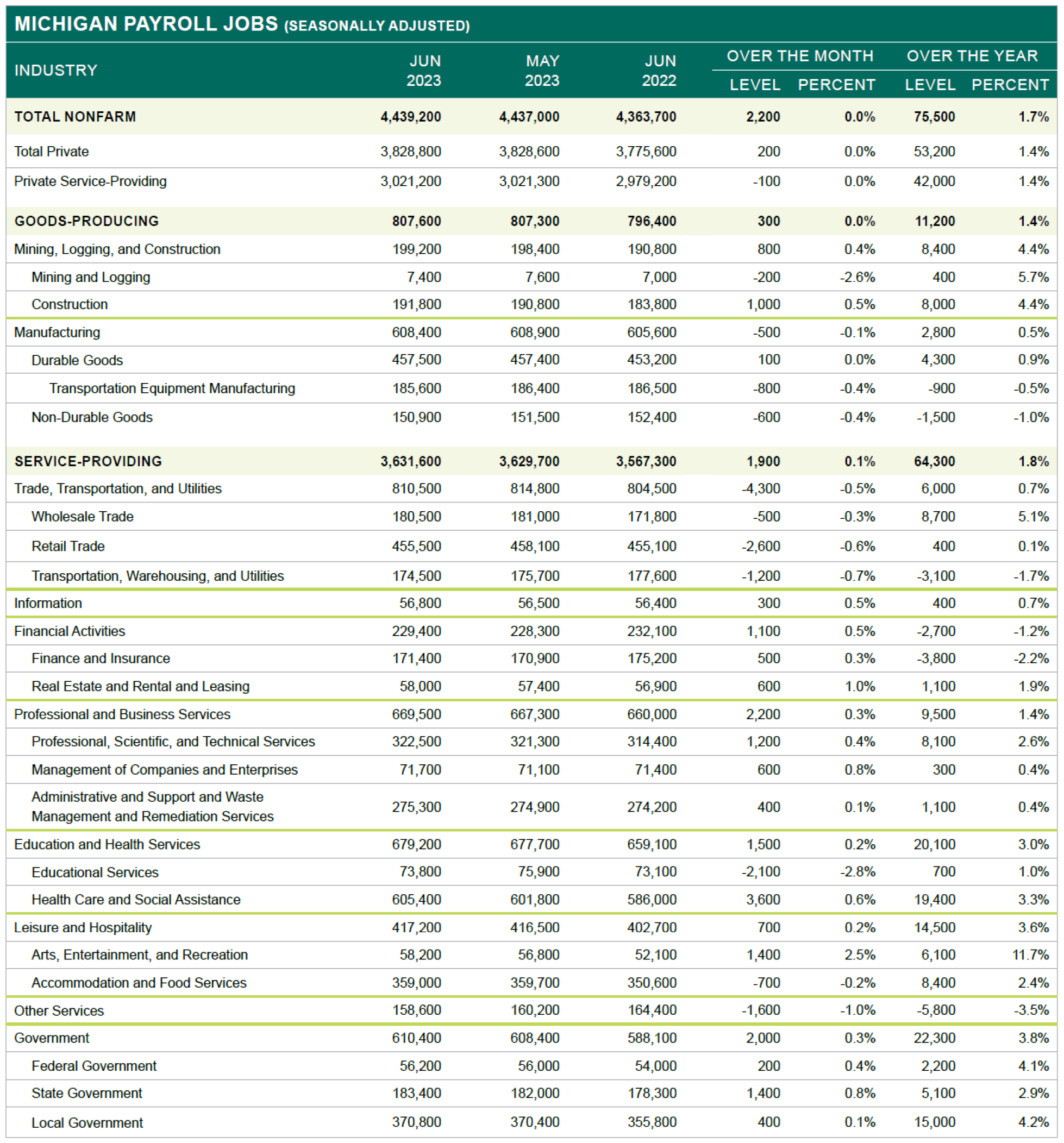

MICHIGAN NONFARM PAYROLL JOBS DISPLAY MODEST INCREASE IN JUNE

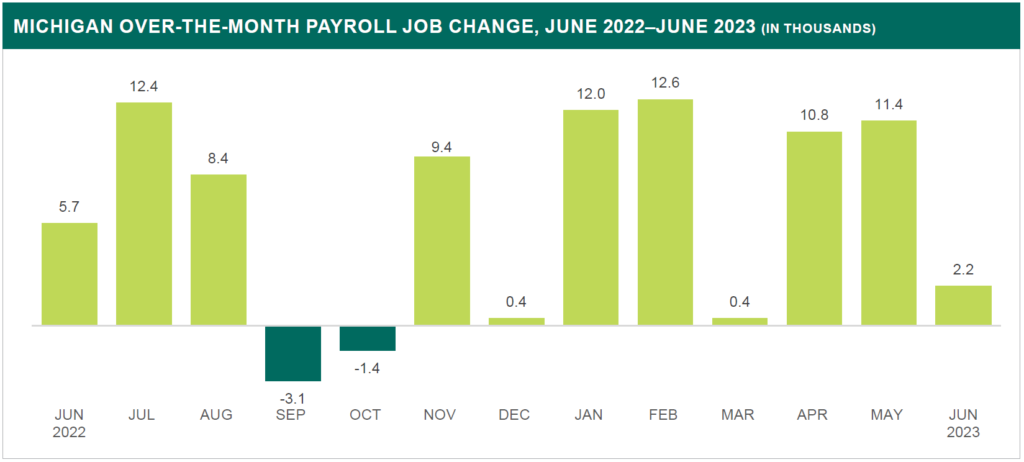

On a seasonally adjusted basis, Michigan nonfarm payroll jobs remained virtually flat, rising by only 2,200 during June to 4,439,200. While total payroll employment in Michigan has now risen eight consecutive months, this month’s employment growth was modest when compared to job additions recorded this year. However, as of June 2023, statewide employment was only 0.2 percent, or 10,300, below its February 2020 pre-pandemic job level.

Total nonfarm payroll jobs in the U. S. also rose minimally over the month, edging up by only 0.1 percent (+209,000) during June. On the nationwide level, June marked the 30th consecutive month of seasonally adjusted job gains. Additionally, since June 2022, the U. S. has continued to surpass February 2020 prepandemic job levels.

On a numeric basis, modest job gains occurred within several super-sector industries this month including Professional and business services (+2,200), Government (+2,000), and Private education and health services (+1,500). Consequently, subsectors within these industries also recorded notable job additions over the month. Employment advances were observed in the Health care and social assistance (+3,600) and Professional, scientific, and technical services (+1,200) subsectors.

Despite noteworthy job additions overall, some industries recorded job declines. During June, the largest over-the-month job loss was recorded in the Trade, transportation, and utilities (-4,300) sector. This was primarily due to notable job cuts within three of its subsectors: Retail trade (-2,600), Transportation, warehouse, and utilities (-1,200), and Wholesale trade (-500).

Majority of Major Industry Sectors Recorded Yearly Employment Growth

Since June 2022, seasonally adjusted jobs in Michigan have increased by 1.7 percent (+75,500). Over the same period, the national rate of gain (+2.5 percent) outpaced the statewide rate by 0.8 percentage points. Over the year, nine of Michigan’s 11 major industry sectors exhibited job growth, with strong employment gains led by the Government (+22,300), Private education and health services (+20,100), and Leisure and hospitality (+14,500) sectors. On a percentage basis, notable job gains were recorded within Mining and logging (+5.7 percent) and Construction (+4.4 percent).

Similar trends were observed nationwide as every major industry sector continued to record job additions over the year. Since June 2022, employment grew within Mining and logging (+5.8 percent), Leisure and hospitality (+5.1 percent), and Private education and health services (+4.2 percent).

Job Rates Increase in Most Metro Areas During June

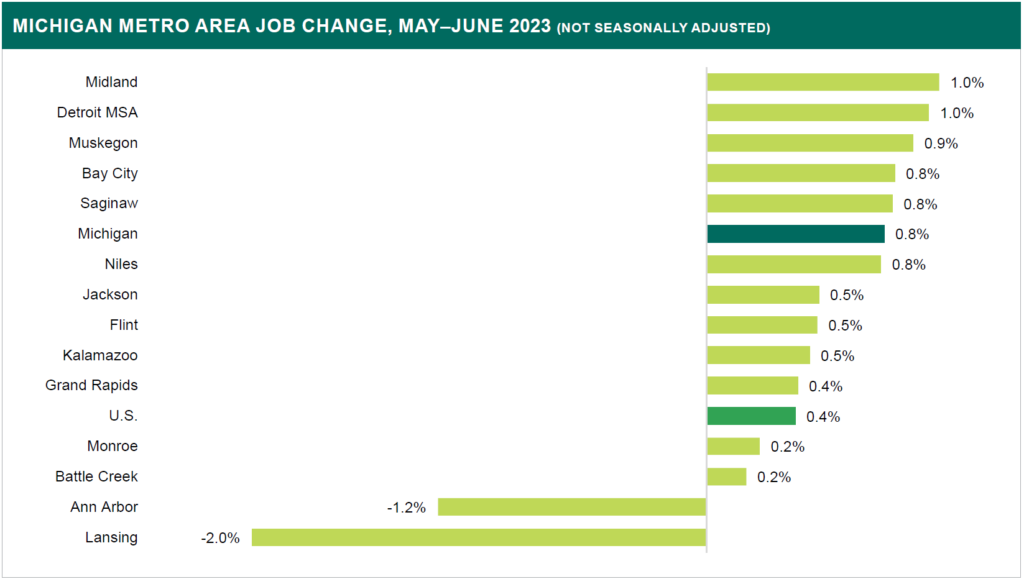

On a not seasonally adjusted basis, 12 of Michigan’s 14 Metropolitan Statistical Areas (MSAs) recorded job growth, while two regions, Lansing and Ann Arbor, observed job declines over the month. Ten of those 12 metro areas recorded employment gains greater than or equal to the national average (+0.4 percent). Six of those 12 metro areas recorded job additions greater than or equal to the statewide average (+0.8 percent).

Over the month, total Mining, logging, and construction; Manufacturing; Professional and business services; and Leisure and hospitality jobs remained either unchanged or increased in all Michigan metro areas. Over the year, only the Government sector recorded no change or job increases in every Michigan metro area.

REIMA NASSER

Economic Analyst

Source: Current Employment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

Source: Current Employment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

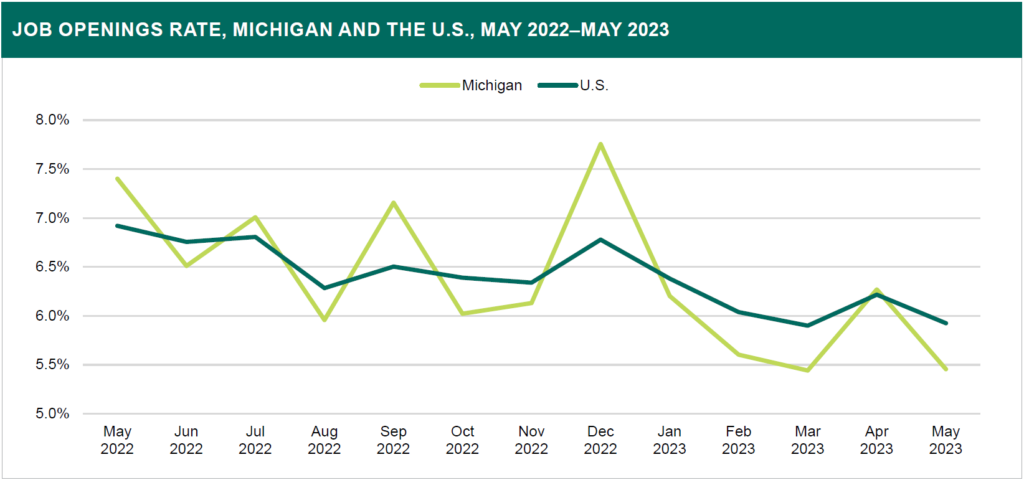

MICHIGAN JOB OPENINGS DECLINE IN MAY

Michigan’s job openings rate (5.5 percent) declined in the May release of the state Job Openings and Labor Turnover Survey (JOLTS). The separations rate (3.7 percent), hires rate (3.7 percent), quits rate (2.4 percent), and labor turnover rate all increased between April and May. The layoffs and discharges rate remained stagnant (1.2 percent).

Job Availability Down in May

Job openings saw a notable dip in May, dropping by approximately 40,000 openings. This was reflected in a declining job openings rate, which dropped nearly a full percentage point from 6.3 percent in April to 5.5 percent in May. Michigan’s job openings rate was below the national rate in May (5.9 percent) and was the 10th lowest among other states.

The unemployed persons to openings ratio saw an increase in May to 0.70. Based on this ratio, there were approximately seven available workers for every ten job openings. This is due to the number of unemployed falling at a faster rate than job openings. Michigan’s ratio was the 9th highest in May and was higher than the national ratio (0.62).

Hires Saw a Minor Rise

The hires rate increased by 0.2 percentage points from 3.5 percent in the prior month to 3.7 percent in the latest data release. This was shown in a numeric increase of approximately 13,000 hires in May (166,000) than in April (153,000). Despite this increase, Michigan’s hires rate ranked among the lowest 10 states (8th).

Separations Continue to Trend Upward

Michigan’s separations rate increased by 0.4 percentage points from April to May, moving to 3.7 percent. This was below the national rate at the time (3.8 percent) and was one of the lowest rates of separations of all states (11th).

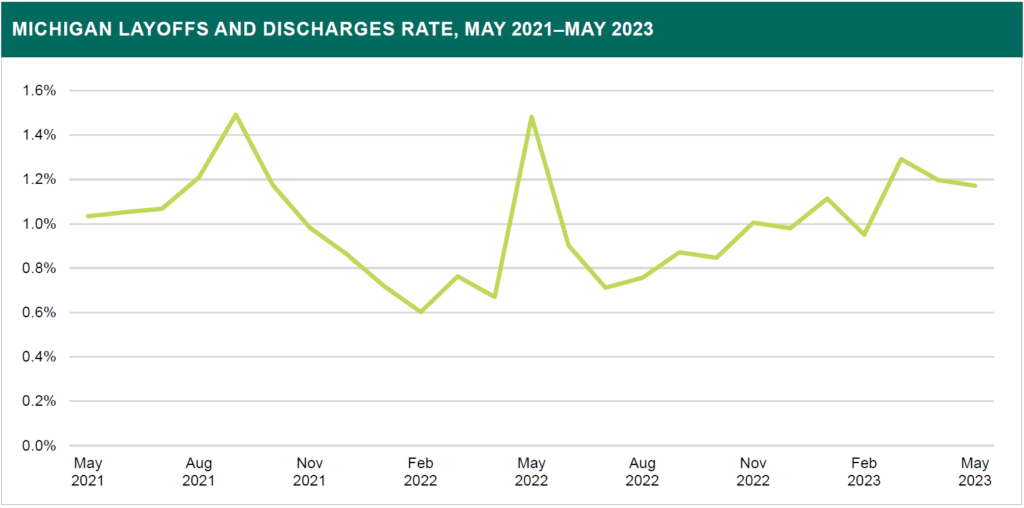

The increase in separations in May can be attributed to an increase in quits. The quits rate jumped from 2.0 percent in April to 2.4 percent in May. Michigan had the 11th lowest rate of quits and was marginally below the national quits rate (2.6 percent). Layoffs and discharges were stagnant over the month. Michigan registered a rate of 1.2 percent in this indicator for the second consecutive month.

Employer-Led Separations Inching Forward

As mentioned previously, there was no change in the layoffs and discharges rate between April and May. The data however shows that this indicator has been slowly inching higher over the past year. As a measure of involuntary or employer-led separations, the slow rise in the layoffs and discharges rate may be another subtle indicator of decreasing labor demand as more employers opt to part ways with their employees. This trend (coupled with the quits rate which, despite a deviation from the trend in May, has begun to inch downward) may be indicative of separations being increasingly employer-driven in the coming months.

KRYSTAL JONES

Economic Analyst

Source: Job Openings and Labor Turnover Survey, U.S. Bureau of Labor Statistics

Disclaimer

The Above Information was created and disseminated by the Department of Technology, Management, and Budget and the Bureau of Labor Market Information and Strategic Initiatives from the State of Michigan. Specialized Staffing does not hold any rights or ownership to this content. For more information, please contact your Michigan Bureau of Labor Representative.