October Data - December Reporting

MICHIGAN UNEMPLOYMENT RATE ADVANCES IN OCTOBER

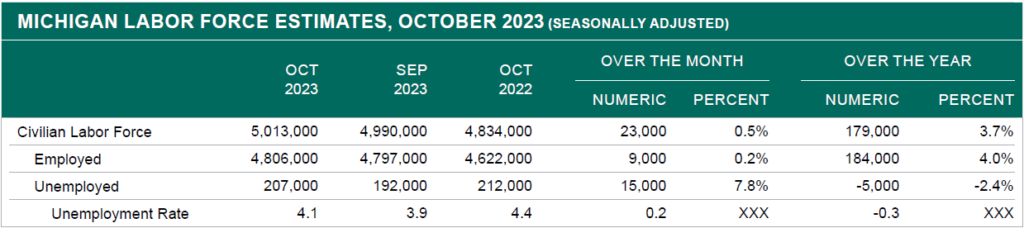

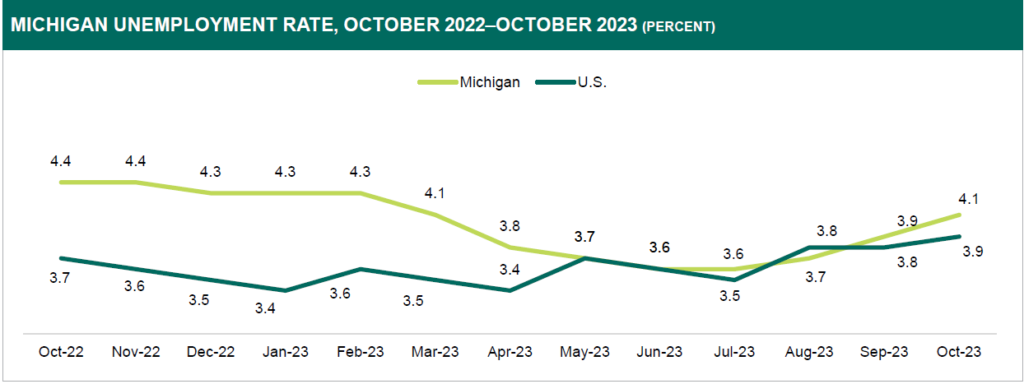

On a seasonally adjusted basis, Michigan’s unemployment rate increased by two-tenths of a percentage point to 4.1 percent during October.

Over the month, the U.S. unemployment rate inched up by one-tenth of a percentage point to 3.9 percent. The statewide unemployment rate was 0.2 percentage points above the national rate. Like the trends seen last month, Michigan’s jobless rate of 4.1 percent was greater than most states. In October, Michigan’s unemployment rate tied with Texas as the 10th highest rate in the nation. Across the U.S., unemployment rates ranged from 1.7 percent in Maryland to 5.4 percent in Nevada.

The U.S. unemployment rate advanced by two-tenths of a percentage point over the year, contrary to the three-tenths of a percentage point reduction observed statewide. Since October 2022, Michigan’s unemployment rate decrease of three-tenths of a percentage point was tied with Alabama as the 20th largest drop in the nation.

Since September 2023, Michigan’s labor force levels rose by 0.5 percent, while the U.S. workforce decreased slightly by 0.1 percent. Statewide employment levels edged up by 0.2 percent over the month, while national employment levels declined by 0.2 percent. Over the month, total unemployment in Michigan jumped by 7.8 percent, while total unemployment in the U.S. rose by 2.3 percent. October unemployment totals were heavily influenced by strike-related layoff activity in Michigan’s auto sector.

Source: Local Area Unemployment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

Source: Local Area Unemployment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

Michigan’s labor force rose by 3.7 percent over the year, 1.8 percentage points above the national workforce gain. Since October 2022, statewide employment levels advanced by 4.0 percent, while nationwide employment levels rose by 1.7 percent. Total unemployment in Michigan decreased by 2.4 percent over the year, while total unemployment in the U.S. rose by 7.5 percent.

REIMA NASSER

Economic Analyst

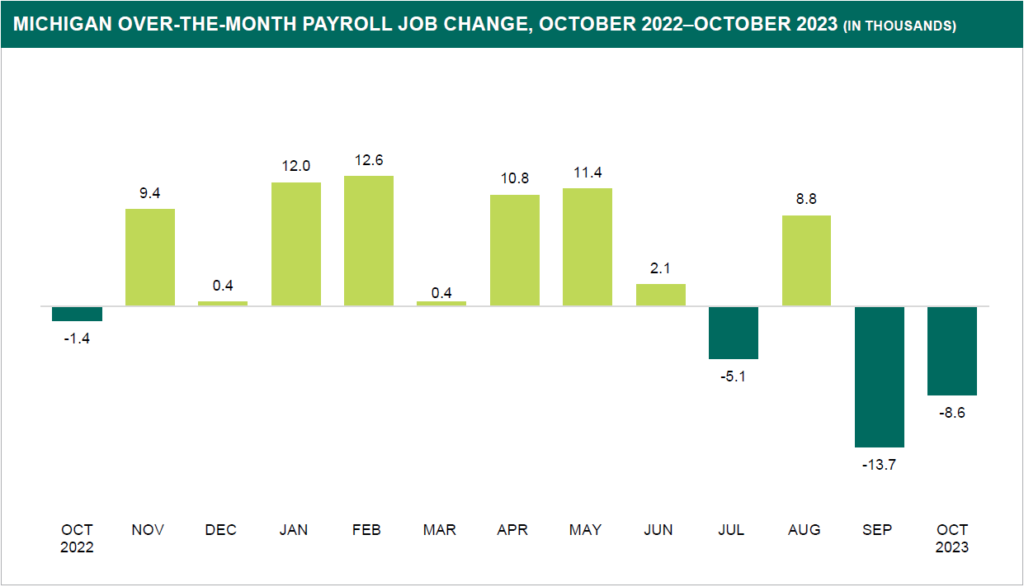

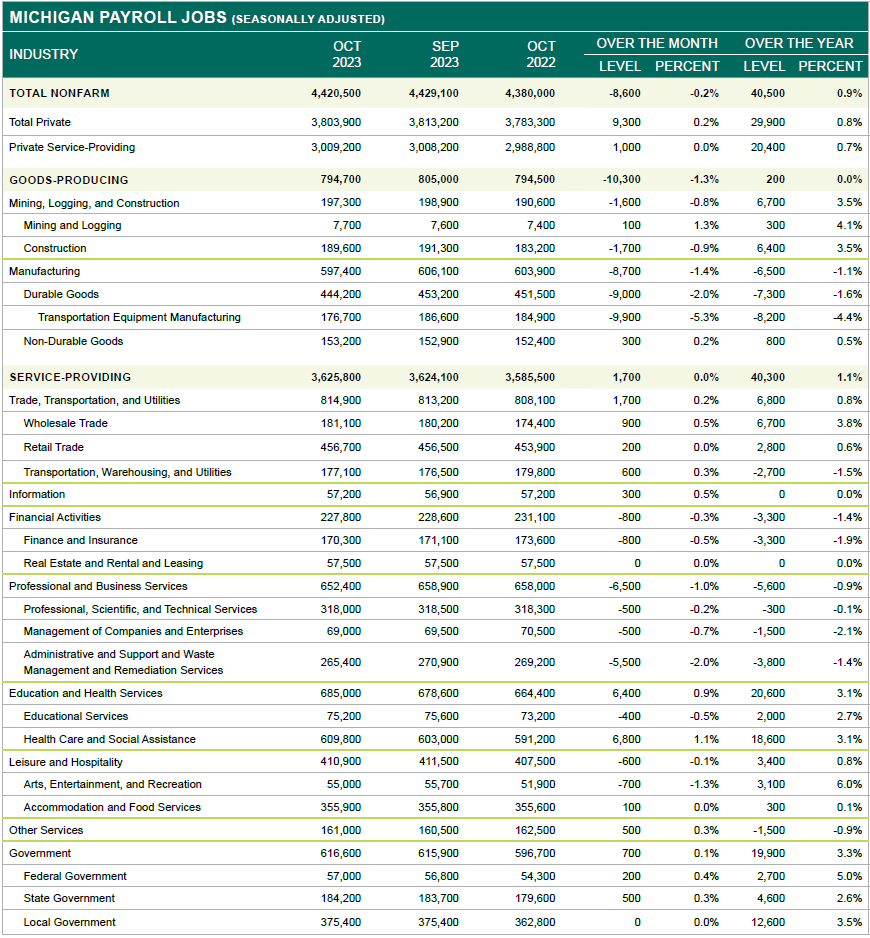

MICHIGAN PAYROLL EMPLOYMENT DECLINES IN OCTOBER

Seasonally adjusted payroll jobs in the state decreased marginally over the month, falling by 8,600 or 0.2 percent to 4,420,500 in October. Michigan total payroll jobs have now declined in three of the past four months. Statewide employment remained 29,000 or 0.7 percent below its February 2020 pre-pandemic level. Consequently, on a percentage basis, Michigan recorded the 42nd lowest monthly job change among all states during October.

In October, seasonally adjusted national payroll jobs increased minimally over the month, moving up by only 0.1 percent. This increase added yet again to the monthly national job gain streak, which began in December 2020.

Six of Michigan’s 11 statewide supersectors recorded seasonally adjusted job gains during October. Numerically, notable job additions were recorded within several major industry sectors including Private education and health services (+6,400) and Trade, transportation, and utilities (+1,700). Other noteworthy employment upticks occurred within the Government (+700) and Other services (+500) sectors. The Manufacturing sector recorded the largest job decline (-8,700) among Michigan’s supersectors due mainly to the UAW strike and related layoffs. The Professional and business services sector also noted a significant decrease during October, falling -6,500 or 1.0 percent, over the month.

Nationally, seasonally adjusted job gains were recorded in a variety of major industry sectors including the Mining and logging, Construction, Professional and business services, Private education and health services, Leisure and hospitality, and Government. Jobs in the Manufacturing and Information sectors both declined during October.

Yearly Job Change Mixed Among Michigan Major Industry Sectors

Over the year, six of Michigan’s 11 major industry sectors recorded seasonally adjusted job growth since October 2022. Subsequently, total nonfarm payroll jobs on the statewide level increased by 40,500 or 0.9 percent during that period. However, this rate increase ranked 47th lowest among all states. Only Iowa, Mississippi, and Rhode Island recorded lower over-theyear rate changes. The largest major industry additions occurred within the Private education and health services (+20,600) and Government (+19,900) sectors. Noteworthy job changes were also recorded within Trade, transportation, and utilities (+6,800) and Construction (+6,400).

Nationally, total nonfarm payroll jobs increased by 2,917,000 or 1.9 percent since October 2022, on a seasonally adjusted basis. The Mining and logging (+4.9), Private education and health services (+4.2 percent), Leisure and hospitality (+3.6 percent), and Government (+2.8 percent) industry sectors recorded the largest yearly job gains. The Information (-2.9 percent) sector was the only major industry in the U.S. to decline over the year.

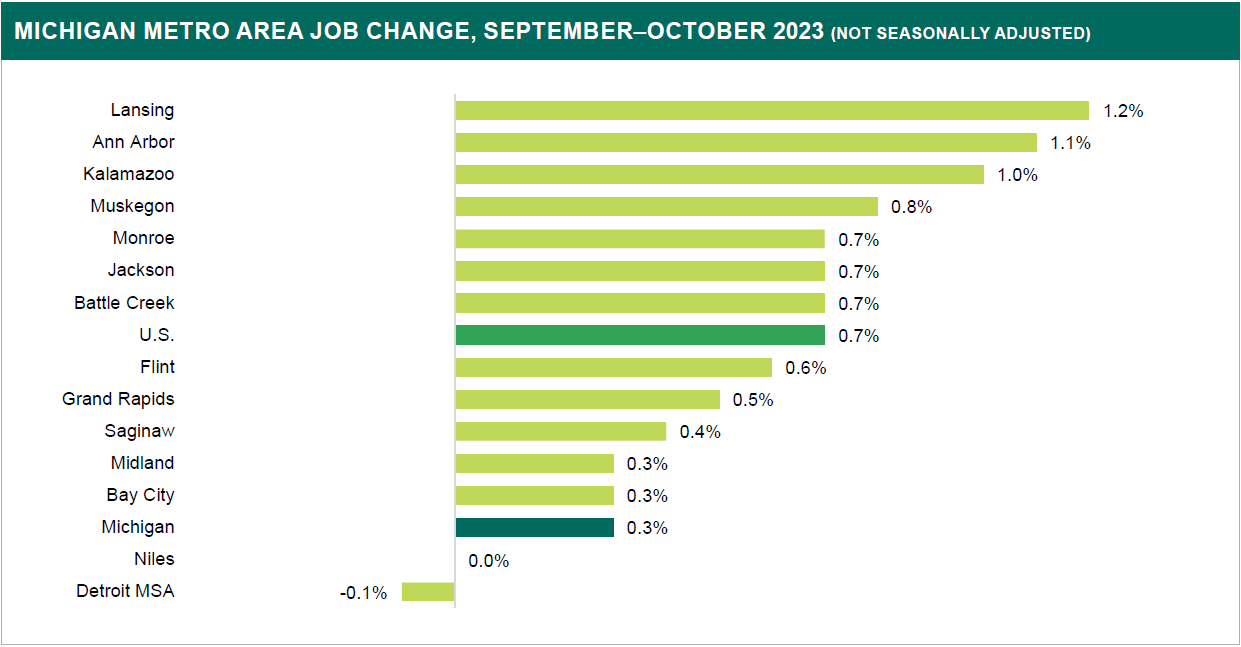

Most Michigan Metro Areas Record Job Gains During October

On a not seasonally adjusted basis, 12 of Michigan’s 14 Metropolitan Statistical Areas (MSAs) recorded job gains during October. Only four regions recorded a job level change at or below the statewide rate of change (+0.3 percent), including Midland, Bay City, Niles, and the Detroit MSA.

In October, jobs within many metro area Trade, transportation, and utilities; Private education and health services; and Government industry sectors recorded typical, seasonal employment additions.

On the contrary, many job counts within region’s Manufacturing sector recorded notable employment declines.

Over the year, 13 of Michigan’s 14 regions recorded total payroll job growth. The Detroit MSA (-0.1 percent) was the only region to note an over the year job decline. Ann Arbor (+3.4 percent), Midland (+2.6 percent), and Bay City (+2.0 percent) recorded the three largest rate changes since October 2022.

JIM BIRNEY

Economic Analyst

Source: Current Employment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

Source: Current Employment Statistics, Michigan Center for Data and Analytics, Michigan Department of Technology, Management & Budget

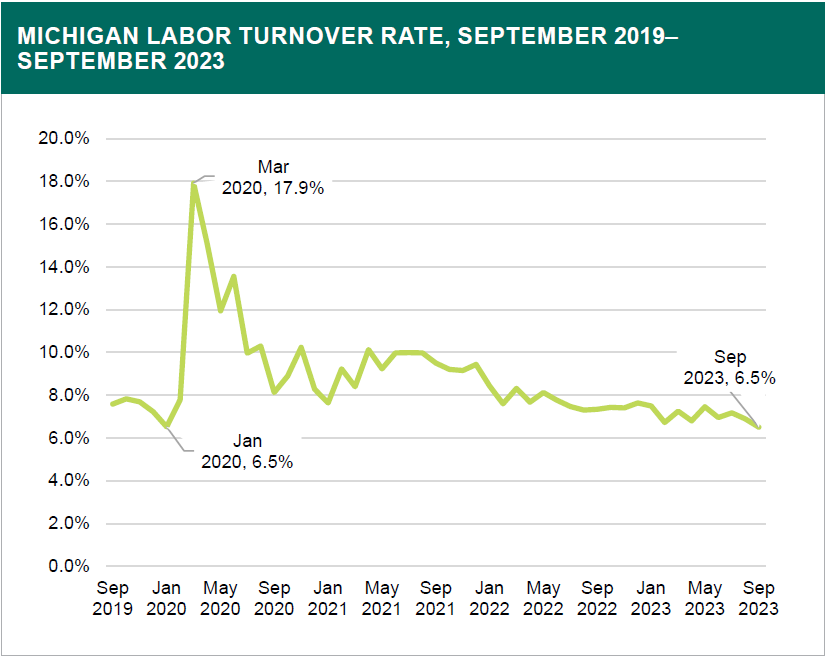

LABOR TURNOVER CONTINUES TO TREND DOWNWARD IN SEPTEMBER

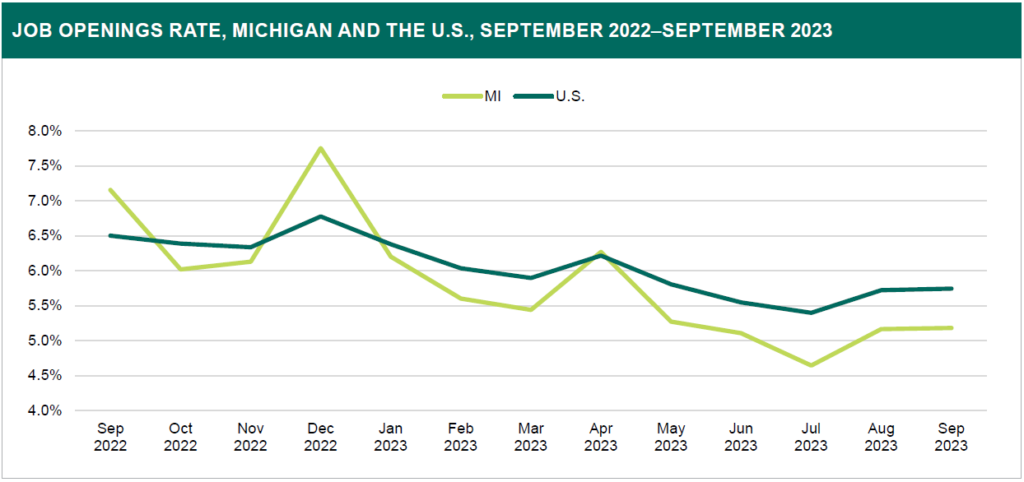

Michigan’s job openings rate (5.2 percent) was unchanged over the month in the September release of the Job Openings and Labor Turnover Survey (JOLTS). The hires rate (3.2 percent), separations rate (3.3 percent), and labor turnover rate (6.5 percent) all declined over the month. The unemployment to job openings ratio was the only indicator to increase over the month (0.79).

Job Openings Stagnated in September

There were approximately 242,000 recorded job openings for the second consecutive month in Michigan. This was reflected in a stagnant 5.2 percent job openings rate. Michigan was below the national rate at the time (5.7 percent) and had the eighth lowest job openings rate among states.

The unemployed persons to job openings ratio crept up to 0.79 from 0.76 in the previous month. This meant that for every 10 job openings, there were approximately eight available individuals. Michigan’s ratio was higher than the national average (0.67) and had the 12th highest of all other states.

Hires Inched Downward

Michigan employers hired approximately 13,000 less employees in September, dropping from 153,000 in the month prior to 140,000. Subsequently, the hires rate declined by 0.2 percentage points to 3.2 percent. As a result of this decline, Michigan fell to having the fourth lowest hires rate in the nation. This was also below the 3.7 percent national rate in September.

Separations Continue to Decline

Similarly, separations have been inching downward: over the past month, Michigan’s separations rate dropped by 0.1 percentage points to 3.3 percent. Though the change was marginal, it dropped Michigan’s ranking among states to the ninth lowest separations rate in September. This was below the national rate at the time (3.5 percent).

The decline in separations was driven by a drop in the layoffs/discharges rate, which fell to 1.1 percent in September. The quits rate, another input in the separations rate, was recorded at 2.1 percent for the third consecutive month. Michigan has consistently been a state with one of the lowest quits rates, which continued over the past month as Michigan tied for eighth lowest in this metric.

Labor Turnover Reach Near Three-Year Low

Since peaking at 17.9 percent in March 2020, Michigan’s labor turnover rate has trended downward. This decline in the turnover rate has now reached 6.5 percent in September 2023, the lowest this rate has been since January 2020 where it also recorded 6.5 percent. The current trend seems to be a continuation of the slowing labor market, as less employees opt to leave their jobs possibly due to less openings and fewer hires.

KRYSTAL JONES

Economic Analyst

Source: Job Openings and Labor Turnover Survey, U.S. Bureau of Labor Statistics

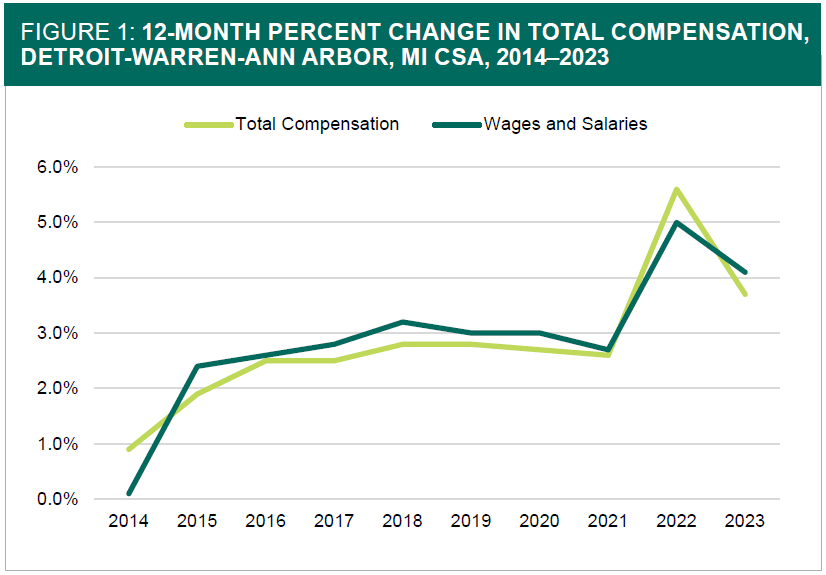

EMPLOYER’S COSTS FOR COMPENSATION

Michigan Compensation Costs for Employees

As of September 2023, wages and salaries in Michigan increased 4.1 percent while total compensation increased 3.7 percent over the previous 12 months. This was considerably lower when compared with growth seen between September 2021 to September 2022 (5.0 percent for wage and salary and +5.6 percent for total compensation).

Annual increases to wages and salaries remained relatively constant from 2015 through 2021, averaging 2.8 percent, until 2022 when the rate jumped to 5.0 percent. The most recent 12-month period registered wage growth of 4.1 percent in September 2023 (Figure 1).

As expected, total compensation followed a similar trend to wages and salaries during the 2014-2023 period. Total compensation peaked slightly higher at 5.6 percent over the year growth in September 2022 when compared to the increase of wages and salaries increase of 5.0 percent during the same period. The most recent data for compensation indicates an increase of 3.7 percent in September 2023.

National Compensation Costs for Employees

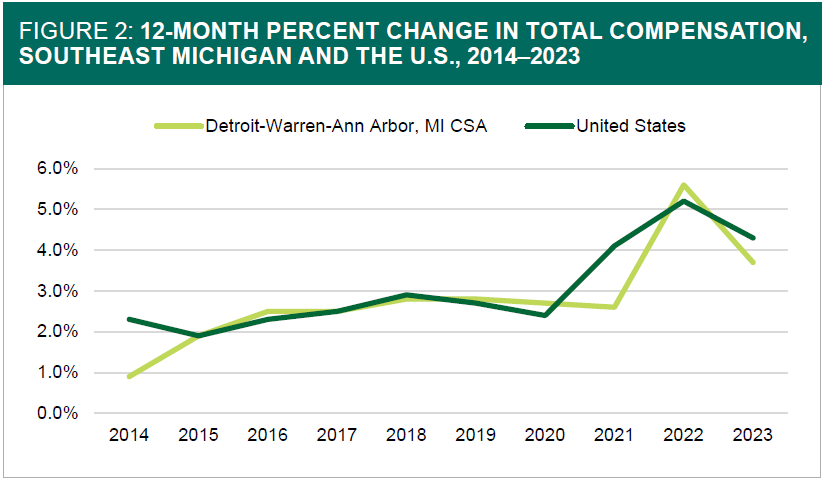

Total compensation in Southeast Michigan followed the same general trend as the United States as a whole (Figure 2). From 2014 until 2020, total compensation gains in the U.S. remained relatively constant at around 2.4 percent. Over the year compensation growth saw a dramatic increase of 2.8 percentage points from 2.4 percent in September 2020 to 5.2 percent in September 2022. This is similar to the rate of 5.6 percent experienced in Southeast Michigan, up from 2.7 percent during the same period. The 12-month period ending in September 2023 saw gains to employee compensation in the U.S. subside to 4.3 percent, slightly higher than Southeast Michigan’s 3.7 percent. U.S. compensation growth was moderately lower in September 2023 than during the period ending September 2022 (5.2 percent).

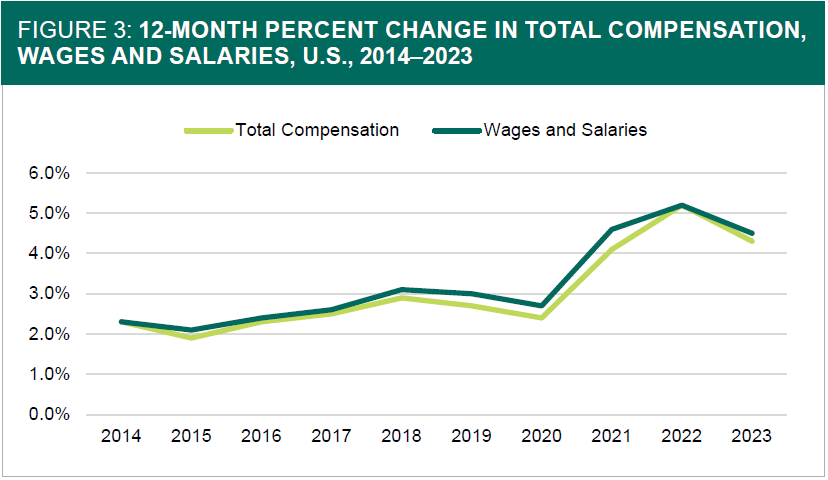

The trend of wages followed closely to total compensation for the United States (Figure 3), comparable to the relationship in Southeast Michigan. Growth generally increased from 2.3 percent in the period ending September 2014 until it reached 3.1 percent in 2018. Growth rates declined slightly in 2020 to 2.7 percent before almost doubling to 5.2 percent in 2022. Wage growth subsided to 4.5 percent in the most recent data.

Disclaimer

The Above Information was created and disseminated by the Department of Technology, Management, and Budget and the Bureau of Labor Market Information and Strategic Initiatives from the State of Michigan. Specialized Staffing does not hold any rights or ownership to this content. For more information, please contact your Michigan Bureau of Labor Representative.