Michigan Labor Market Review

December Data - February Reporting

A RESOURCE PROVIDED FOR EMPLOYERS IN THE GREATER MICHIANA AREA

MICHIGAN JOBLESS RATE REMAINS STABLE IN DECEMBER

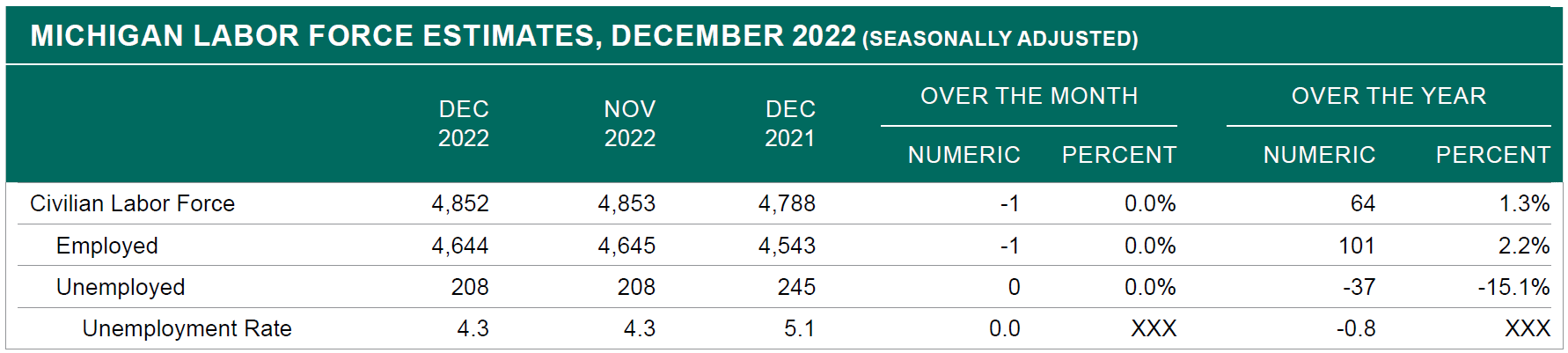

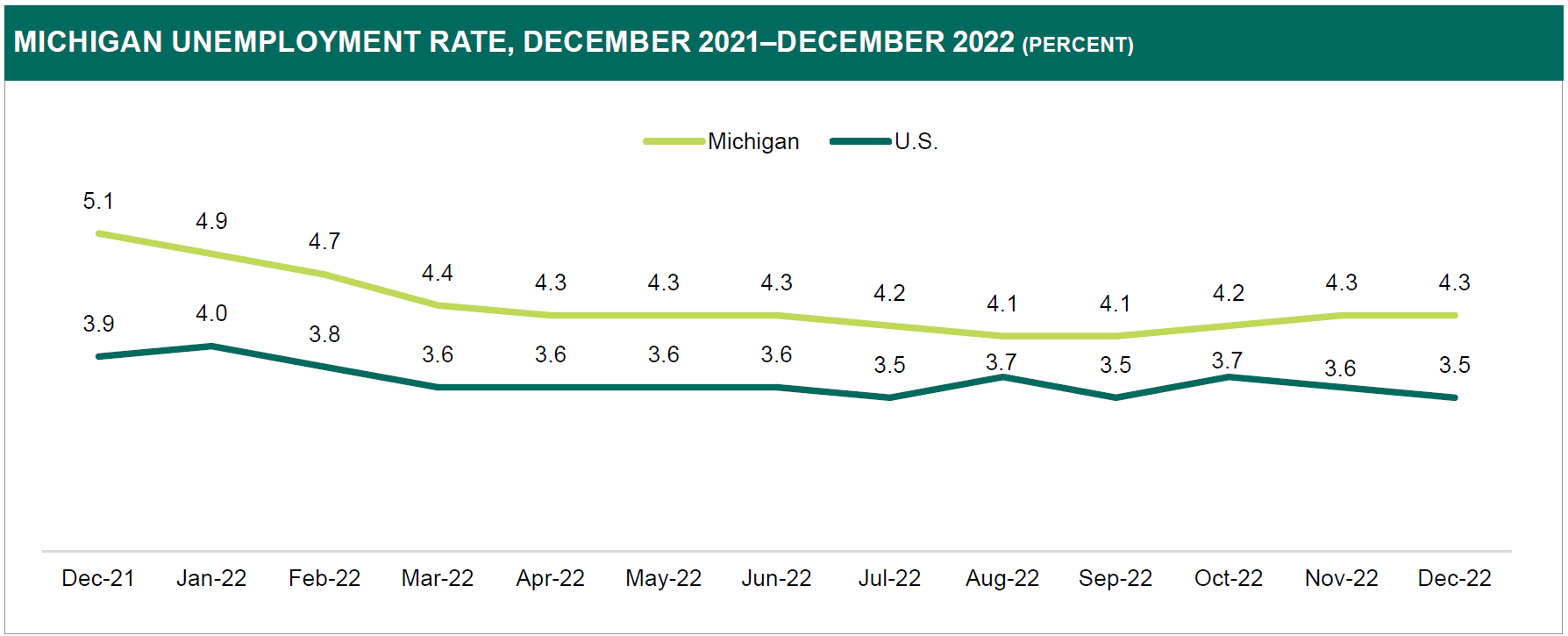

Michigan’s seasonally adjusted unemployment rate was unchanged for the second consecutive month in December, remaining at 4.3 percent.

The national unemployment rate edged down one-tenth of a percentage point between November and December to 3.5 percent. At the statewide level, the unemployment rate was eight-tenths of a percentage point above the U.S. rate. Since December 2021, the national unemployment rate receded by 0.4 percentage points, while the statewide unemployment rate fell by 0.8 percentage points.

Michigan’s labor force was nearly unchanged this month, while the U.S. labor force edged up by 0.3 percent over the month. Employment levels were also stable in the state over the month, while national employment rose by 0.5 percent. Statewide unemployment remained flat over the same period, contrary to the reduction of 4.6 percent observed nationally.

Michigan’s total workforce increased by 1.3 percent over the year, while the U.S. workforce advanced by 1.6 percent. Over the year, statewide employment growth was two-tenths of a percentage point above the national employment expansion (+2.0 percent). Total unemployment in the state fell by 15.1 percent since December 2021, while total unemployment in the U.S. fell by 9.6 percent.

Statewide annual average data reveals that the jobless rate in 2022 was 4.3 percent. This was 1.6 percentage points below the jobless rate in 2021 (5.9 percent). This annual average rate was also slightly above the average unemployment rate of 4.1 percent for 2019. In Michigan’s 17 major labor market areas, changes in the average unemployment rate between 2021 and 2022 ranged from 0.5 to 2.1 percentage points, with all areas experiencing notable declines. In 2022, 11 of the 17 major areas recorded annual unemployment rate averages greater than the statewide annual average (4.3 percent).

REIMA NASSAR

Economic Analyst

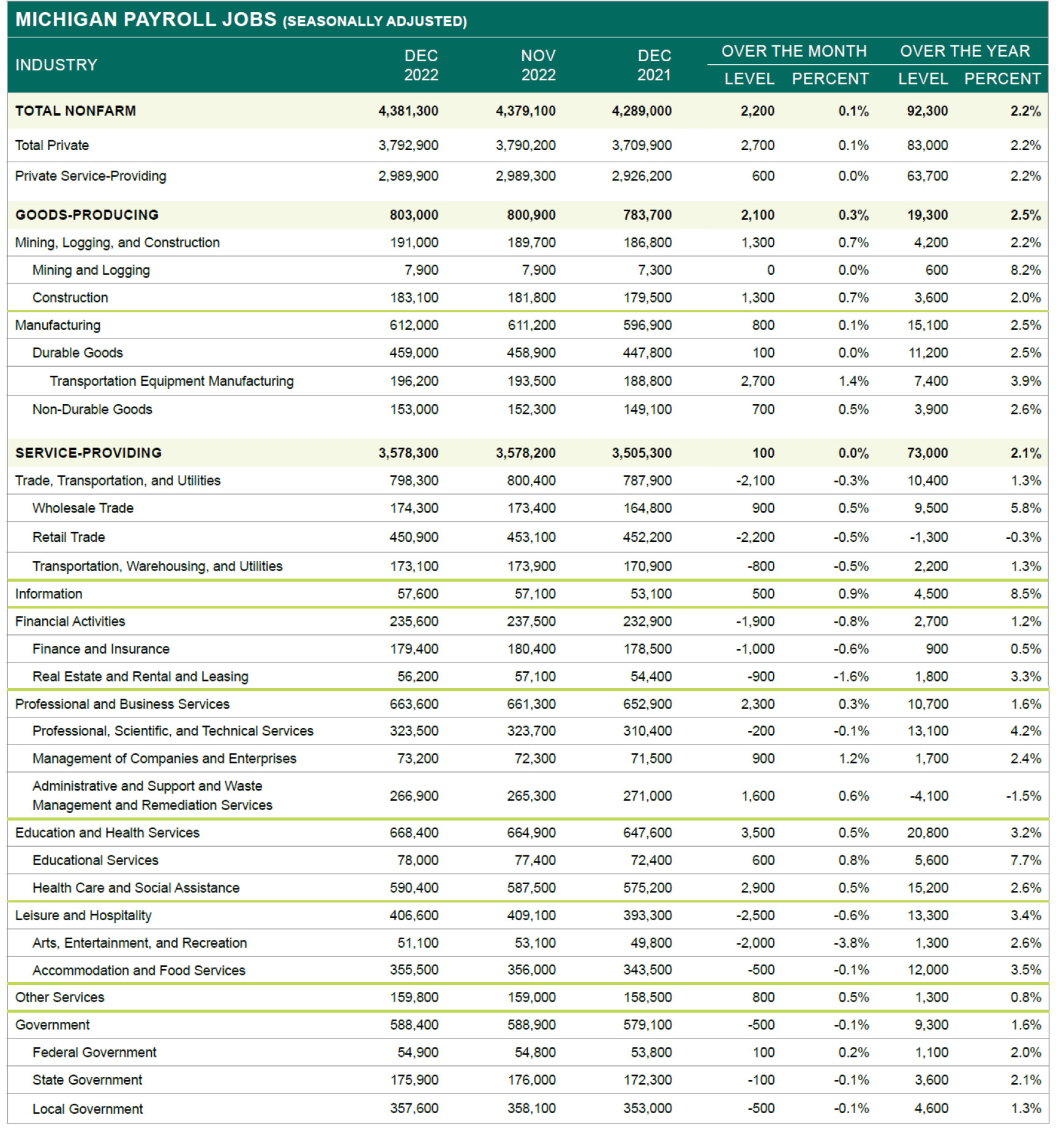

MICHIGAN JOB TRENDS BY INDUSTRY SECTOR

Monthly Overview

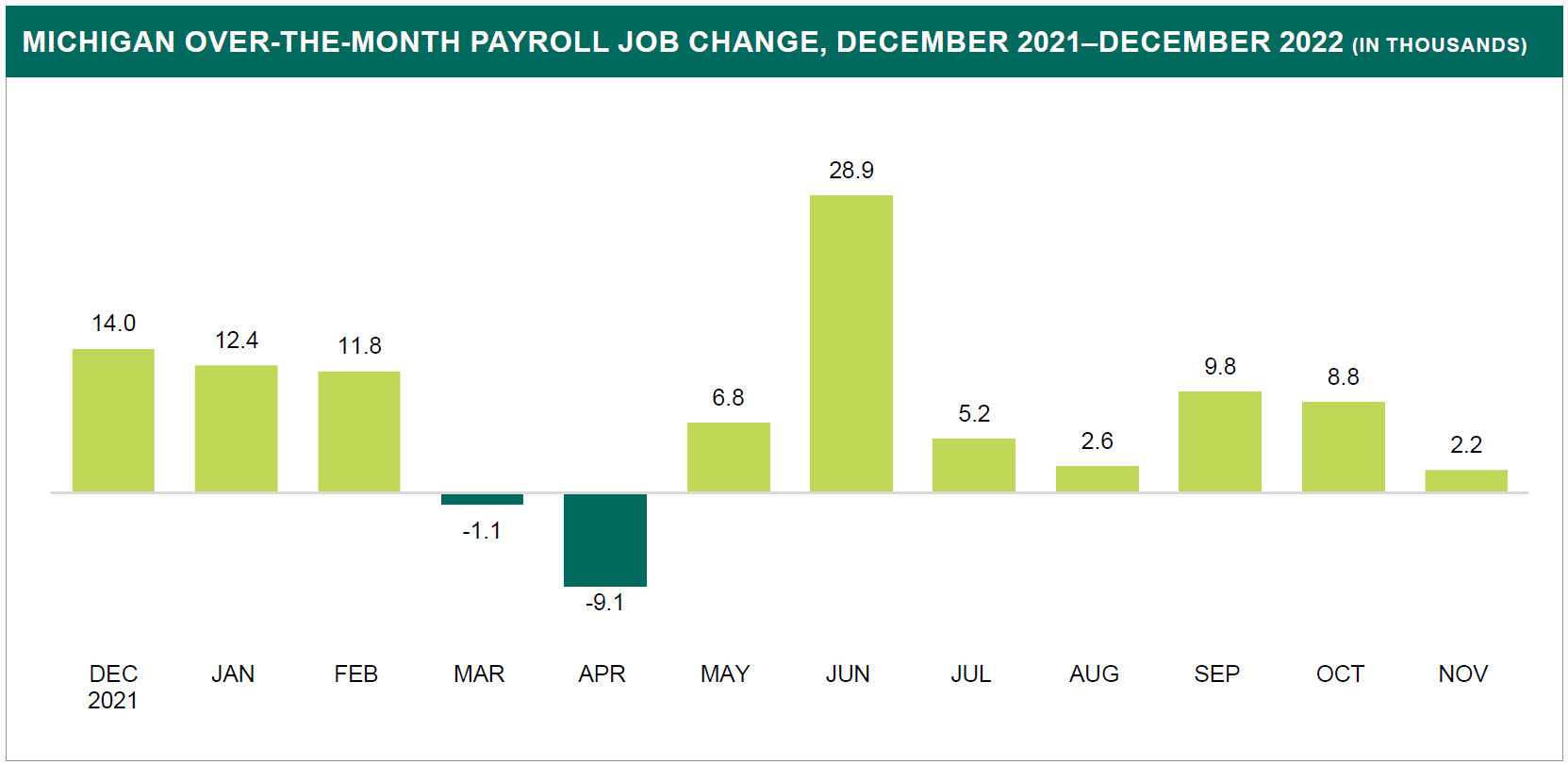

On a seasonally adjusted basis, Michigan payroll jobs edged up by 0.1 percent (+2,200) to 4,381,300 in December. While December marked the seventh consecutive month of job gains statewide, this month’s employment growth was very modest when compared to job additions recorded in the last six months. As of December 2022, statewide employment remained lower (-1.6 percent) than its February 2020 pre-pandemic level.

Nationwide, total nonfarm payroll jobs edged up 0.1 percent (+223,000) over the month, similar to the statewide change. On a seasonally adjusted basis, December marked the 24th consecutive month, or second complete year, of recorded job advances in the United States. The U.S. surpassed its February 2020 pre-pandemic job levels in multiple months in 2022.

On a numeric basis, modest job gains occurred within the Education and health services (+3,500), Professional and business services (+2,300), and Construction (+1,300) industry sectors. In December, several industries recorded job declines too. Notable cuts were recorded within the Leisure and hospitality (-2,500); Trade, transportation, and utilities (-2,100); and Financial activities (-1,900) sectors. On a percentage basis, the greatest job losses occurred in the Arts, entertainment, and recreation (-3.8 percent) and Real estate and rental and leasing (-1.6 percent) subsectors.

Compared to pre-pandemic job levels, many of Michigan’s sectors and subsectors still have not recovered all jobs lost. On a numeric basis, sectors with job levels below pre-pandemic levels include the Leisure and hospitality (-29,000), Government (-28,300), and Education and health services (-23,500), and Retail trade (-12,200) sectors. On a percentage basis, subsectors including State government (-9.4 percent), Accommodation and food services (-7.0 percent), and Administrative and support and waste management and remediation services (-5.7 percent) recorded the largest job losses over the same period. Despite these losses, subsectors including Professional, scientific, and technical services (+7.8 percent) and Transportation equipment manufacturing (+4.3 percent) surpassed their pre-pandemic job levels this month.

Over-the-Year Analysis

Since December 2021, Michigan payroll jobs advanced by 92,300 or 2.2 percent, eight-tenths of a percentage point below the national increase (+3.0 percent). Every major industry recorded job additions over the year, with strong employment gains led by the Education and health services (+20,800); Manufacturing (+15,100); and Trade, transportation, and utilities sectors (+10,400). Notable increases on a percentage basis occurred within the Information (+8.5 percent) and Mining and logging (+8.2 percent) industries.

Metropolitan Statistical Areas (MSAs)

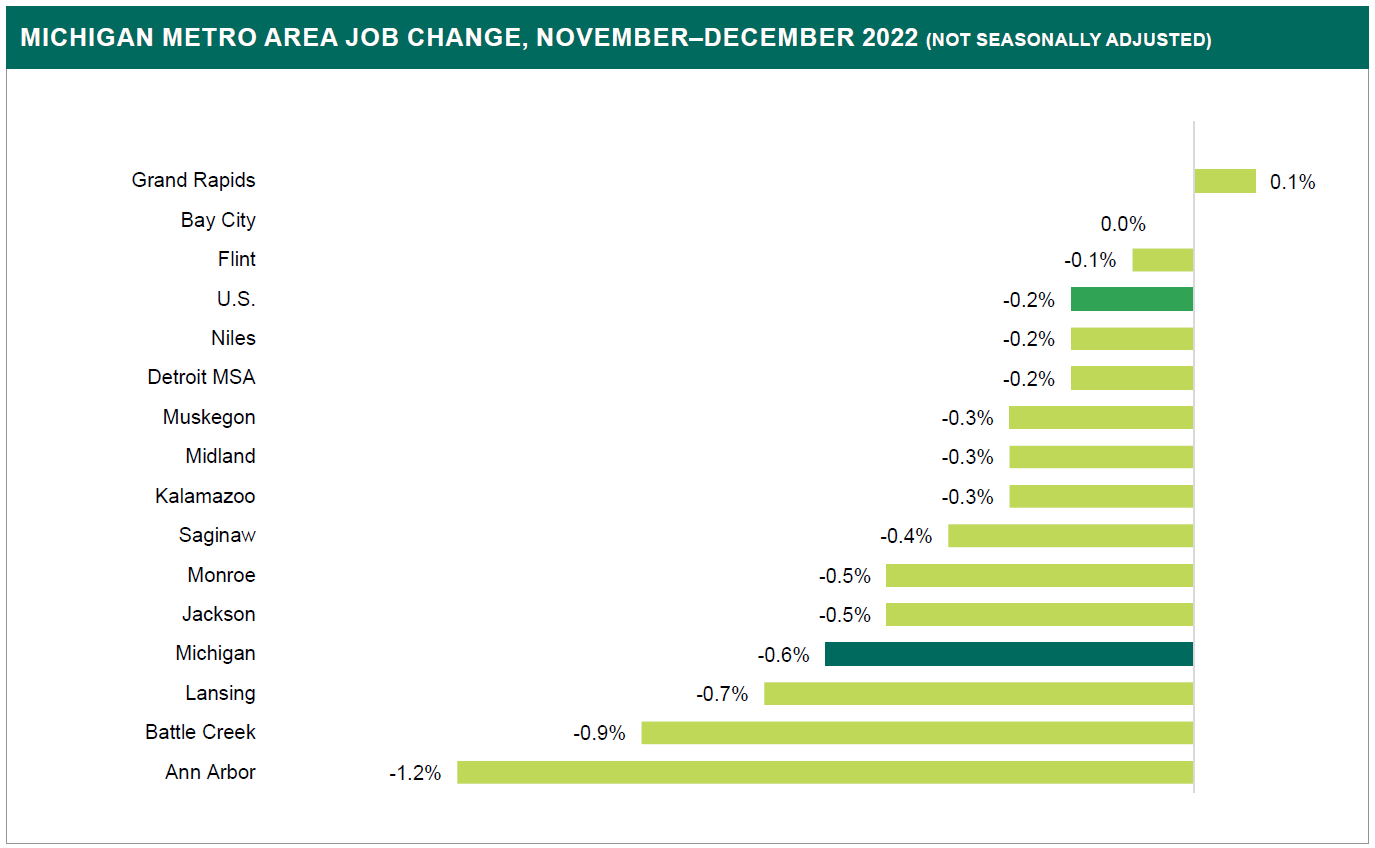

On a not seasonally adjusted basis, 12 of Michigan’s 14 Metropolitan Statistical Areas (MSAs) recorded job losses over the month. Eleven of those 12 metro areas recorded job losses less than or equal to the national average (-0.2 percent) and three metro areas recorded job losses less than the state average (-0.6 percent). Monthly job changes ranged from +0.1 percent (Grand Rapids) to -1.2 percent (Ann Arbor) during December.

Every metro area, except Jackson (-0.7 percent) and Monroe (-0.3 percent), recorded a total payroll job gain over the year. The most notable job movement occurred within the Lansing (+4.5 percent) and Grand Rapids (+3.8 percent) MSAs. Since December 2021, Midland was the only MSA to record an unchanged job rate over the year.

REIMA NASSAR

Economic Analyst

MICHIGAN HIRES RATE STABILIZED IN RECENT MONTHS

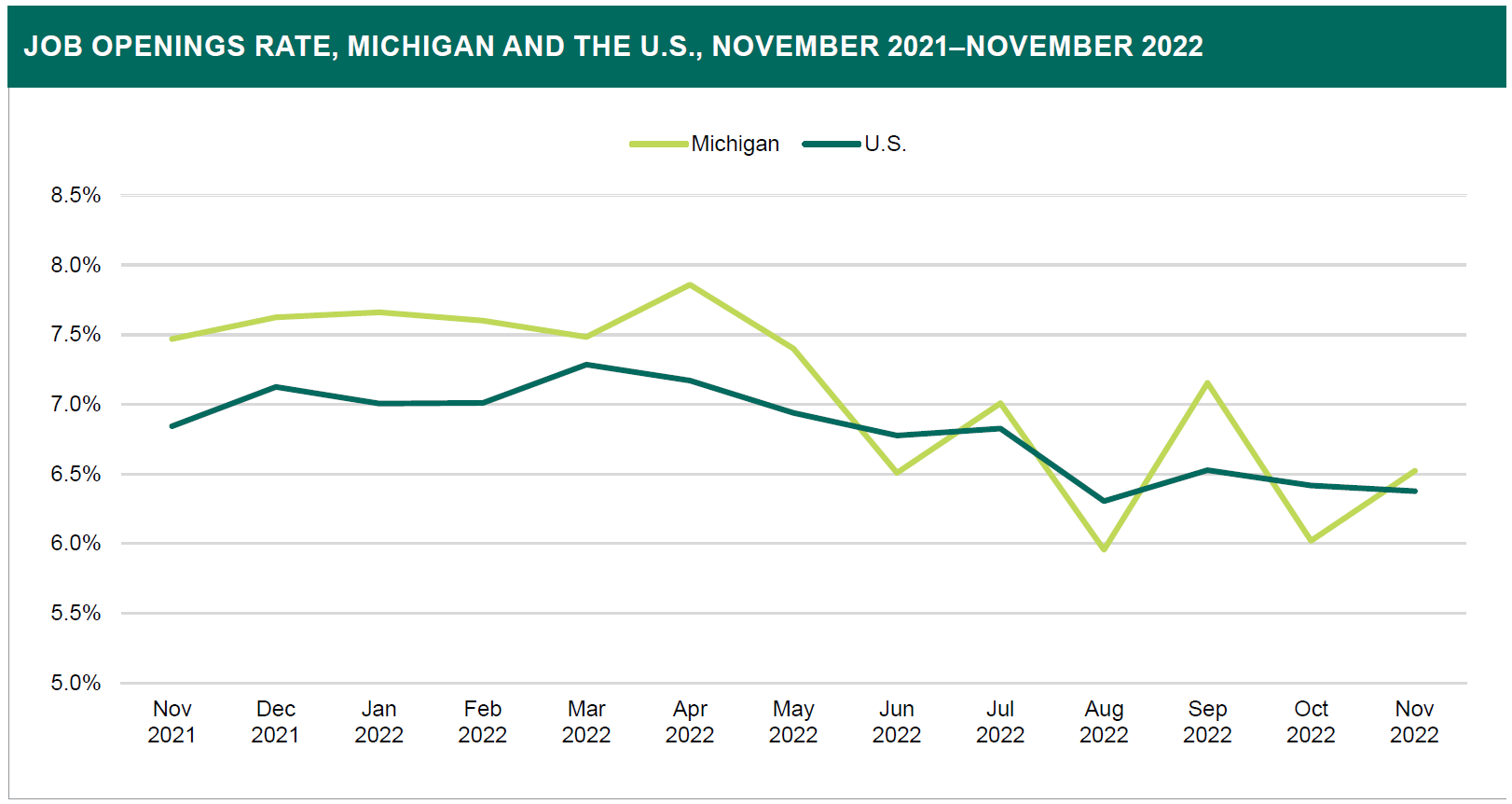

Job openings increased by half a percentage point in the latest release of Michigan Job Openings and Labor Turnover (JOLTS) data for November (6.5 percent). Similarly, the separations rate (3.6 percent) and layoffs and discharges rate (0.9 percent) increased marginally over the month. Both labor turnover and quits were stagnant over the month, while the hires rate experienced a minor decline (3.8 percent).

Job Openings

Job openings grew marginally in November, with approximately 26,000 additions, increasing the openings rate to 6.5 percent. This moved Michigan to the state with the 25th highest rate of openings, a jump from 40th in the month prior. Michigan was higher than the national rate over this period (6.4 percent).

The openings to unemployed persons ratio dropped from 0.73 in October to 0.68 in November. This translated to there being nearly seven unemployed persons per ten job openings, which was higher than the national rate (0.58) during the same time.

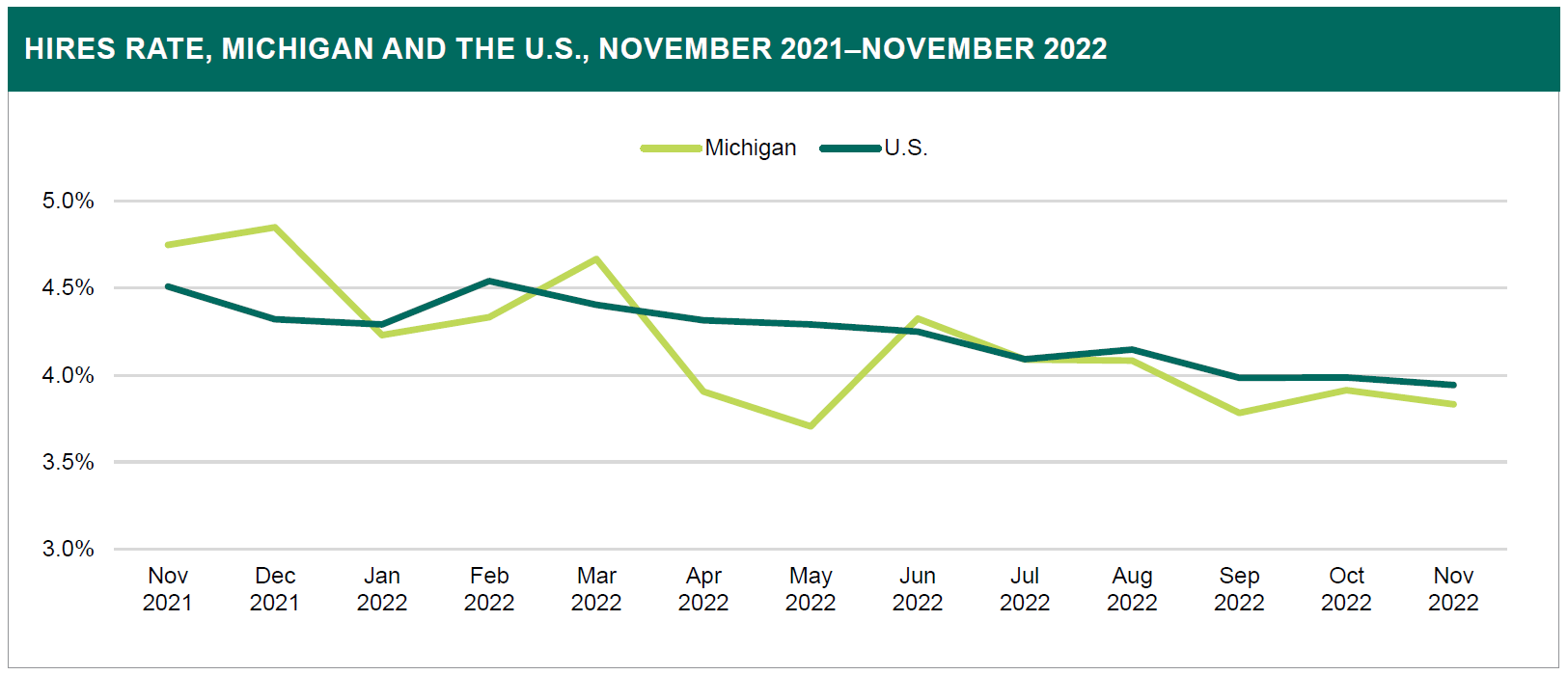

Hires

The hires rate for Michigan decreased by 0.1 percentage point from October to November, down from 3.9 percent to 3.8 percent, respectively. This was reflected in the hiring of approximately 3,000 less employees in the state than in the month prior. Michigan had the 32nd highest rate of hires, a modest increase from 38th in October. This was only marginally below the national rate during the month (3.9 percent).

Separations

Employees separated from their jobs at a slightly higher rate than the previous month as the separations rate increased by 0.1 percentage point to 3.6 percent. This was shown in roughly 3,000 more separations in November (157,000) than October (154,000). Michigan’s separations rate was below the national rate (3.8 percent).

The quits rate was stagnant at 2.5 percent for the second consecutive month. Michigan was below the national rate for November (2.7 percent). Layoffs and discharges were up marginally, with a 0.1 percentage point increase in the rate in November (0.9 percent).

Michigan’s Hires Rate Converged with the U.S.

Like other JOLTS labor demand indicators, Michigan’s hires rate has stabilized in recent months. Comparing November 2021 to November 2022, the hires rate has dropped nearly a full percentage point from 4.7 percent to 3.8 percent. Most notably however is the way in which Michigan’s rate has fallen in line with the national hires rate. From November 2021 through the first half of 2022, Michigan’s hires rate experienced more volatility and noted departures from the national trend. The largest gap occurred in April of 2022, in which the statewide and national rates were 3.8 percent and 4.7 percent, respectively. Since midpoint of 2022, Michigan’s hires rate has seen smaller monthly changes and has begun to trend closer to the national rate.

KRYSTAL JONES

Economic Analyst

Disclaimer

The Above Information was created and disseminated by the Department of Technology, Management, and Budget and the Bureau of Labor Market Information and Strategic Initiatives from the State of Michigan. Specialized Staffing does not hold any rights or ownership to this content. For more information, please contact your Michigan Bureau of Labor Representative.